04 April 2022 Print this page. On this page Which tax rates apply Before you use the calculator Information you need for this calculator What this calculator doesnt cover Access the calculator.

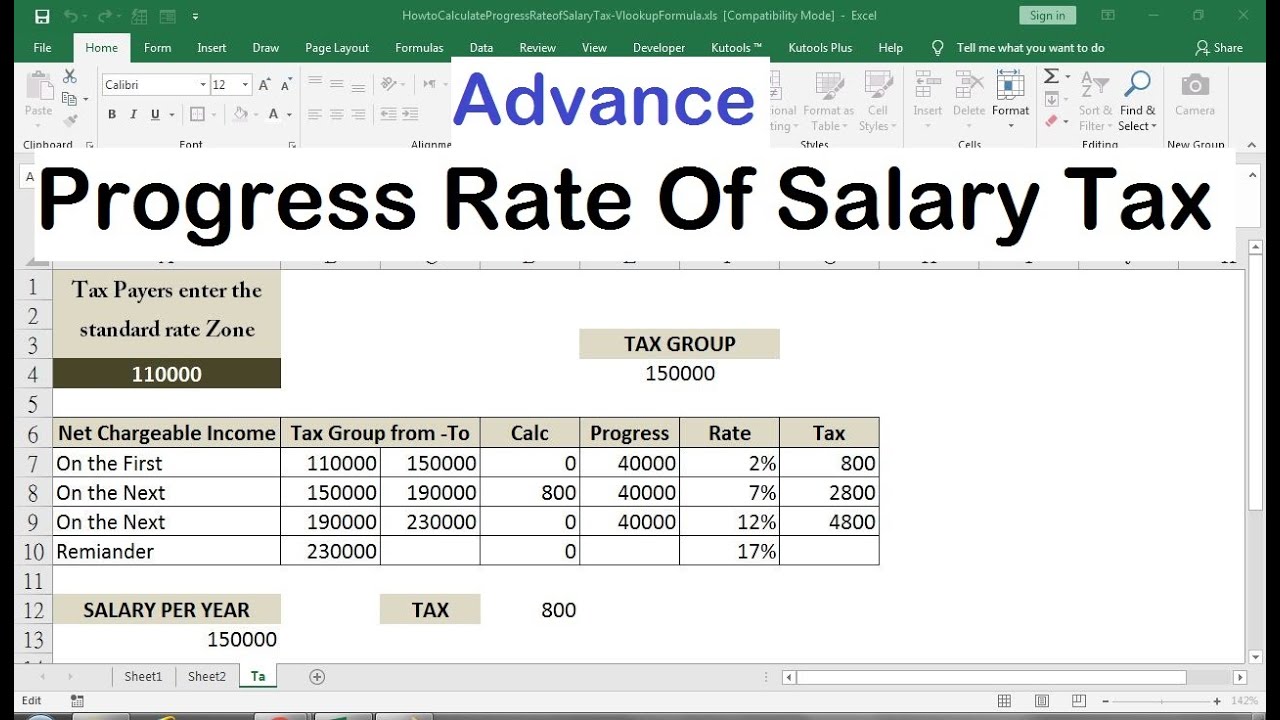

Tax Calculator Excel Spreadsheet Excel Spreadsheets Spreadsheet Excel

Use our employees tax calculator to work out how much PAYE and UIF tax you will pay SARS this year along with your taxable income and tax rates.

. 54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. It is advised that for filing of returns the exact calculation may be made as per the provisions contained in the relevant Acts Rules etc. To calculate your Income Tax IT you will need to understand how tax credits and rate bands work.

Use our employees tax calculator to work out how much PAYE and UIF tax you will pay SARS this year along with your taxable income and tax rates. Your Tax Credit Certificate. What is the difference between gross and taxable pay.

Use our income tax calculator to estimate how much youll owe in taxes. FAQ Blog Calculators Students Logbook Contact LOGIN. Note that your personal allowance decreases by 1 for every 2 you earn over 100000.

Federal Income Tax Return Calculator Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. Note that it does not take into account any tax rebates or tax offsets you may be entitled to. The first 9950 is taxed at 10 995 The next 30575 is taxed at 12 3669 The last 5244 is taxed at 22 1154 In.

Pension contributions Payments to a Permanent Health Benefit Scheme to a maximum of 10 of income. Various deductions to calculate income tax on salary 1. On income between 12571 and 50270 youll pay income tax at 20 - known as the basic rate.

Before Tax Price Sales Tax Rate After Tax Price Related VAT Calculator What is Sales Tax. Helps you work out. Using the brackets above you can calculate the tax for a single person with a taxable income of 41049.

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Once your Personal Allowance has been taken away the remaining amount will be taxed and your Personal Allowance will be left tax free. Before-tax price sale tax rate and final or after-tax price.

It can be used for the 201314 to 202122 income years. How to calculate your tax. Calculate your personal income tax for 20222023 Use our online income tax calculator designed for individuals to help you work out your estimated monthly take-home pay in South Africa after PAYE pay as you earn tax is deducted from your salary.

Leave Travel Allowance LTA 3. This is a policy that will ensure continued income in the event of an accident injury or sickness. It will not include any tax credits you may be entitled to for example the independent earner tax credit IETC.

Use this calculator to work out your basic yearly tax for any year from 2011 to the current year. Calculating your tax Before calculating your income tax subtract the following from your income. Section 80C 80CCD 1 and 80CCC 5.

How Is Tax Calculated. Between 50271 and 150000 youll pay at 40 known as the higher rate and above 150000 youll pay 45 the additional rate. How much Australian income tax you should be paying what your take home salary will be when tax and the Medicare levy are removed your marginal tax rate This calculator can also be used as an Australian tax return calculator.

Enter your income and other filing details to find out your tax burden for the year. The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all circumstances. It also will not include any tax youve already paid through your salary or wages or any ACC earners levy you may need to pay.

Calculate your federal state and local taxes for the 2021-2022 filing year with our free income tax calculator. Tax credits and rate bands. Simple tax calculator This calculator helps you to calculate the tax you owe on your taxable income for the full income year.

Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators How Much House Can I Afford. Income Liable to Tax at Normal Rate --- Short Term Capital Gains Covered us 111A 15 Long Term Capital Gains Charged to tax 20 20 Long Term Capital Gains Charged to tax 10 10 Winnings from Lottery Crossword Puzzles etc 30 Income Tax Surcharge Education Cess Secondary and higher education cess Total Tax Liability. Unless you are earning over 125140 then your tax is calculated by simply taking your Personal Allowance amount away from your income.

House Rent Allowance HRA 2. Deductions Against Loans How to calculate income tax on salary with example Calculate employee salaries with just a few clicks FAQs. Tax rates bands and reliefs.

Enter your income and location to estimate your tax burden.

Free Weekly Payroll Tax Worksheet Payroll Taxes Payroll Template Payroll

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Corporate Tax Calculator Template For Excel Excel Templates

Tax Calculation Spreadsheet In 2022 Spreadsheet Template Spreadsheet Excel Formula

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price Finance Career Financial Analysis Sales Tax

Taxable Income Calculator India Income Business Finance Investing

Freebie How To Calculate Tax Tip And Sales Discount Cheat Sheet 7th Grade Math Teaching Math Sixth Grade Math

Self Employed Tax Calculator Business Tax Self Employment Employment

How To Calculate Agi From W 2 Tax Prep Checklist Income Tax Return Tax Refund

How To Create Excel Data Entry Form With Userform That Calculates Income Tax Full Tutorial

Excel Formula For Reverse Tax Calculation Excel Formula Reverse Excel

What Is Annual Income How To Calculate Your Salary

Self Employed Taxes How To Calculate Your Tax Payments Business Money Tax Money Advice

How To Calculate Income Tax Of Super Senior Citizen Youtube Income Tax Income Senior Citizen

Income Tax Calculation 2019 Rebate 2019 20 Explained Youtube Income Tax Budgeting Income

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Are You Trying To Find A Way To Calculate Your Business Turnover Of This Year We Can Dissolve Your Worries Just Go To Our Webs Calculator You Tried Turnovers

Gst Calculator How To Find Out Goods And Service Tax Tax Refund